Inflation (India) hovering to double digit 17.65% . This means your investments have to earn double digit returns to combat with rising inflation.Here are some ways for you to slug it out with inflation demon.

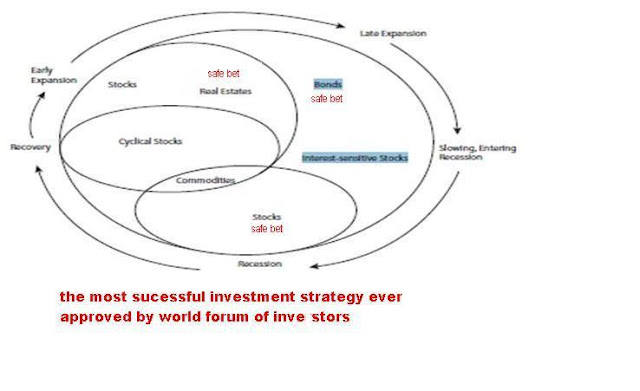

EQUITIES

Equities are considered as the best defence against inflation. When you invest in company you are offering risk capital to that company. The company invests the money in various businesses and with a view of generating profits that could certainly beat inflation and benefit share holders. But this again has a risk factor discussed in (Recession indicators) i.e. when GDP rate matches with rising inflation there are chances of investors withdrawing money from investments be conscious about this.

FIXED DEPOSITS

There are considered as safe investments for people who don't know what an investment is, a wise investor will never do this unless late expansion of recovery is in process. Say inflation is at around 18% and rates of return with FD are 11%max this means you have 7 % deprication of real interest rate on your investment. Instead it would be better to buy a car with 10% depreciation at least you can enjoy a ride.

COMMODITIES

One can also go for agricultural or energy bonds. Going forward emerging giant economies like India & China will consume more energy and agricultural commodities for their growth. It would be a good hedge against inflation. Considering this scenario one can go long for investments in commodities.

REAL ESTATE

Several analyst believe that real estate is strong bet against inflation since it is real asset. It you bought a house at low interest rates it is better because the principal component does not increase that much with that compared to increase in the price of your home. One must also remember that one of the reasons for global crises was real estate prices which became an asset bubble. However in India with GDP growing at 8.5% inflationary pressures should drive up house prises in future. In early 1980's the real estate market in Japan boomed and if one owned a 10,000 sq.ft office in the Imperial place (Japan) he was capable enough to buy the entire state of California by selling that office. The same thing might happen in Mumbai some where around 2025-2030. The recent real estate boom & Burst in Dubai stands an evidence. Always remember history repeats itself.

GOLD & PRECIOUS METALS

Well if one is well off in tracking gold & metal prices they can trade a future contract with commodity exchanges or else one can also buy gold or metal bonds. Gold is considered as safest beet against inflation and has least tendency to fall. The point to be noted is if Indian rupee hardens against the Greenback (U.S Dollars) then Indian gold investors will not be in the position to enjoy the upside fully. Silver being the most volatile so HNI's (High net worth investors) bet on it it also has its large industrial application thus making it volatile. Gold has fraction amount of industrial applications so is less volatile compared to other metals.

So you get a pension plan always remember the growth initial amount invested should match with the rising inflation every year because inflation grows at a compound annual rate of 12% approx is your pension plan capable enough to match the rising inflation at your 60.

My grand father once told me all he needed was Rs. 500 /- a month in 1970's to live an upper middle class life which costs Rs 50,000 /- today we being the second generation growing 100 times and so our grand children will need Rs 50,00,000 /- a month (Ohh a big amt but will be small at that time) and at that time your medical & monthly expenses will cost Rs 8-10 lacs minimum. So plan well with your pension plan else investing in Gold, Real estate & Equities stands a safest bet.

Kuldeep H. P

Making love for economics & Financial analysis